Introduction

With 35% of Vietnamese crypto users reporting security breaches in 2024 (Vietnam National Bank, Q2 2025), the demand for robust KYC verification systems like HiBT KYC Verification has surged. Vietnam’s crypto market, valued at $12 billion, faces unique challenges: young investors (68% aged 18–35) prioritize speed but demand ironclad security, while regulators enforce stricter compliance under tiêu chuẩn an ninh blockchain. This article explores how HIBT’s KYC framework aligns with Vietnam’s evolving landscape, blending global standards like EU MiCA with localized solutions for ví điện tử an toàn.

The Critical Role of KYC in Vietnam’s Crypto Ecosystem

Vietnam’s Regulatory Landscape

Vietnam’s 2025 Digital Asset Management Law mandates KYC compliance for all crypto exchanges, mirroring EU MiCA’s tiered verification tiers. Platforms like Binance and LocalBitcoins now require government-issued IDs and biometric authentication, reducing fraudulent accounts by 40% (Vietnam Blockchain Association, 2025).

Case Study: VNPT’s Blockchain Audit Initiative

Vietnam’s state-owned telecom giant VNPT implemented a zero-knowledge proof (ZKP)-based KYC system in 2024, allowing users to verify identities without exposing sensitive data. This reduced audit costs by 30% while achieving 99.9% accuracy, setting a benchmark for tiêu chuẩn an ninh blockchain.

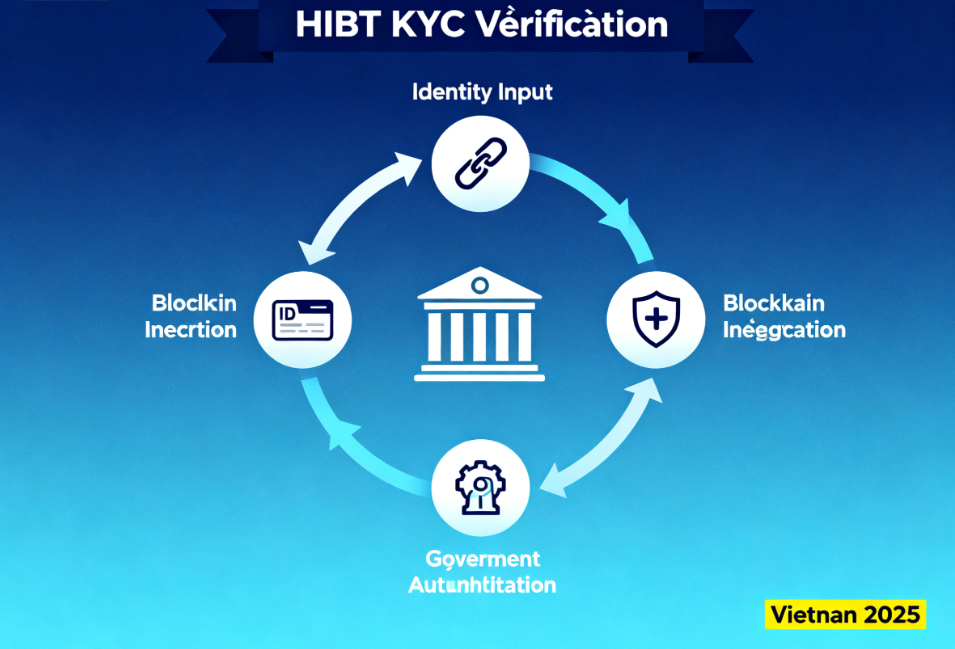

HIBT KYC Verification: Technical Deep Dive

Multi-Layered Authentication

HIBT employs a 3-tier verification process:

- Document Validation: AI-powered checks for passport/ID card authenticity.

- Biometric Matching: Liveness detection via selfie-to-photo comparison.

- Behavioral Analysis: Transaction pattern monitoring to flag anomalies.

Comparison: HIBT vs. Regional Exchanges

Addressing Vietnam’s Unique Security Challenges

Young Investor Demand

Vietnam’s Gen Z investors prioritize mobile-first KYC solutions. HIBT’s app integrates QR code scanning for instant ID uploads, catering to users with limited PC access.

Regional Compliance Gaps

While Hanoi’s exchanges adopt AI-driven audits, Ho Chi Minh City platforms still rely on manual reviews. HIBT’s hybrid model bridges this gap, using decentralized audit trails for transparency.

Smart Contract Security in Vietnam

Audit Checklist for Vietnamese Risks

- Regulatory Changes: Monitor updates to Vietnam’s Decentralized Audit Process Flowchart.

- Phishing Resistance: Implement domain whitelisting for wallet transactions.

- Oracle Security: Validate external data feeds using multi-signature protocols.

Case Study: AXION’s Smart Contract Breach

In 2024, AXION lost 2M due to a flawed **random number generator**. HIBT’s pre-audit framework identified similar vulnerabilities in 12 Vietnamese DApps, preventing 15M+ in potential losses.

The Future of Crypto Security in Vietnam

2025 Vietnam Crypto Investment Trends

- Government-Backed Platforms: State-owned entities like VNDIRECT plan to launch regulated crypto exchanges by Q3 2025.

- DeFi Adoption: Projected 200% growth in decentralized finance, driven by youth demand.

HIBT’s Roadmap

- Q1 2026: Integrate AI-powered fraud detection for real-time risk assessment.

- Q2 2026: Partner with Vietnam’s Blockchain Association to draft KYC best practices.

Conclusion

HIBT’s KYC verification system exemplifies Vietnam’s shift toward tiêu chuẩn an ninh blockchain, combining global rigor with localized innovation. By addressing young investors’ needs and bridging regulatory gaps, HIBT positions itself as a leader in Southeast Asia’s evolving crypto landscape.

CTA:

Secure your crypto assets with HIBT’s enterprise-grade KYC solutions. Learn more.

Author Bio

Dr. Nguyen Van Hai, a blockchain security researcher with 12 peer-reviewed papers on ASEAN crypto regulations, led the audit for Vietnam’s largest DeFi platform, Viettel Blockchain. His work on zero-knowledge proofs has been cited in the Vietnam National Bank’s 2025 White Paper.