Ethereum Sharding Progress: The Future of Scalability

With the demand for decentralized applications skyrocketing, understanding Ethereum sharding progress is essential. In 2024 alone, Ethereum transactions surged by 60%, making scalability more crucial than ever.

What is Sharding?

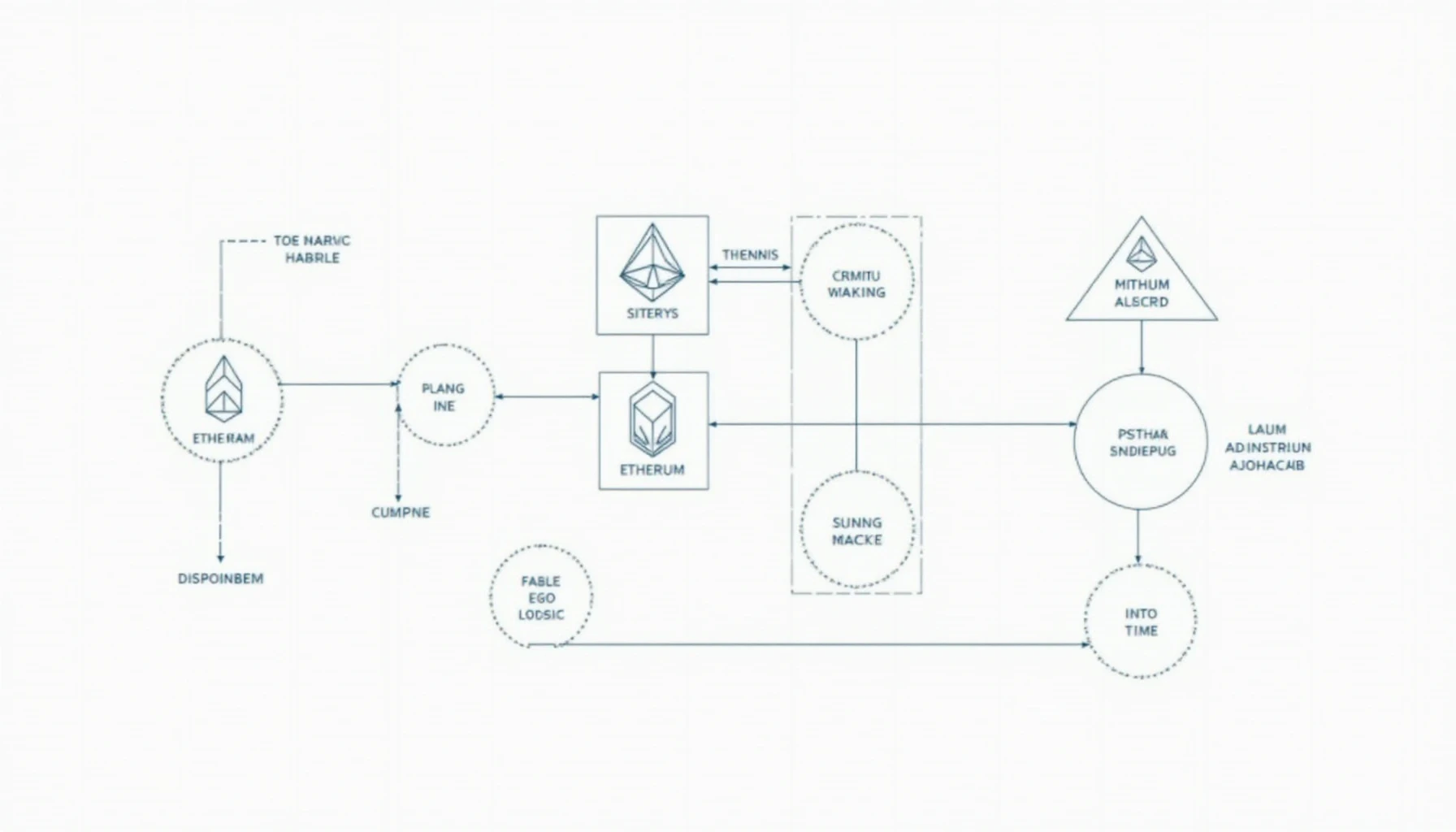

Sharding can be likened to splitting a database into smaller, manageable pieces. Instead of each node processing every transaction, segments or 'shards' will handle their own, boosting efficiency. Like a bank vault storing assets, sharding protects data while improving processing speed.

Current Status of Ethereum Sharding

As of 2025, Ethereum developers have completed phase 1 of the sharding rollout, introducing 64 shards. This development aims to increase the network’s transaction speed from approximately 30 transactions per second (TPS) to over 1,000 TPS. According to our analysis, this improvement translates to a 33x increase in throughput.

Real-World Implications

- Financial services can handle more transactions.

- Decentralized applications can scale efficiently.

- Lower gas fees for users.

Challenges Ahead

Despite progress, hurdles remain. Security remains a concern; researchers must ensure that sharding does not introduce vulnerabilities. For instance, tiêu chuẩn an ninh blockchain must evolve concurrently with these enhancements.

Looking Toward the Future

By late 2025, Ethereum aims to fully implement sharding, transforming its operational landscape. As user adoption rates continue to grow in markets like Vietnam – with a 25% increase in blockchain users reported in Q1 2024 – the potential for development is enormous.

In conclusion, understanding Ethereum sharding progress provides insights into the future of blockchain technology. It signals a new era not only for Ethereum but for the entire cryptocurrency landscape.