Introduction

As the global cryptocurrency market continues to thrive, investors are increasingly concerned about tax implications. In 2024, over $4.1 billion was reported lost to DeFi hacks, prompting users to seek reliable tax tools. Hibt crypto tax tools serve as an essential resource for anyone navigating the complexities of cryptocurrency taxation.

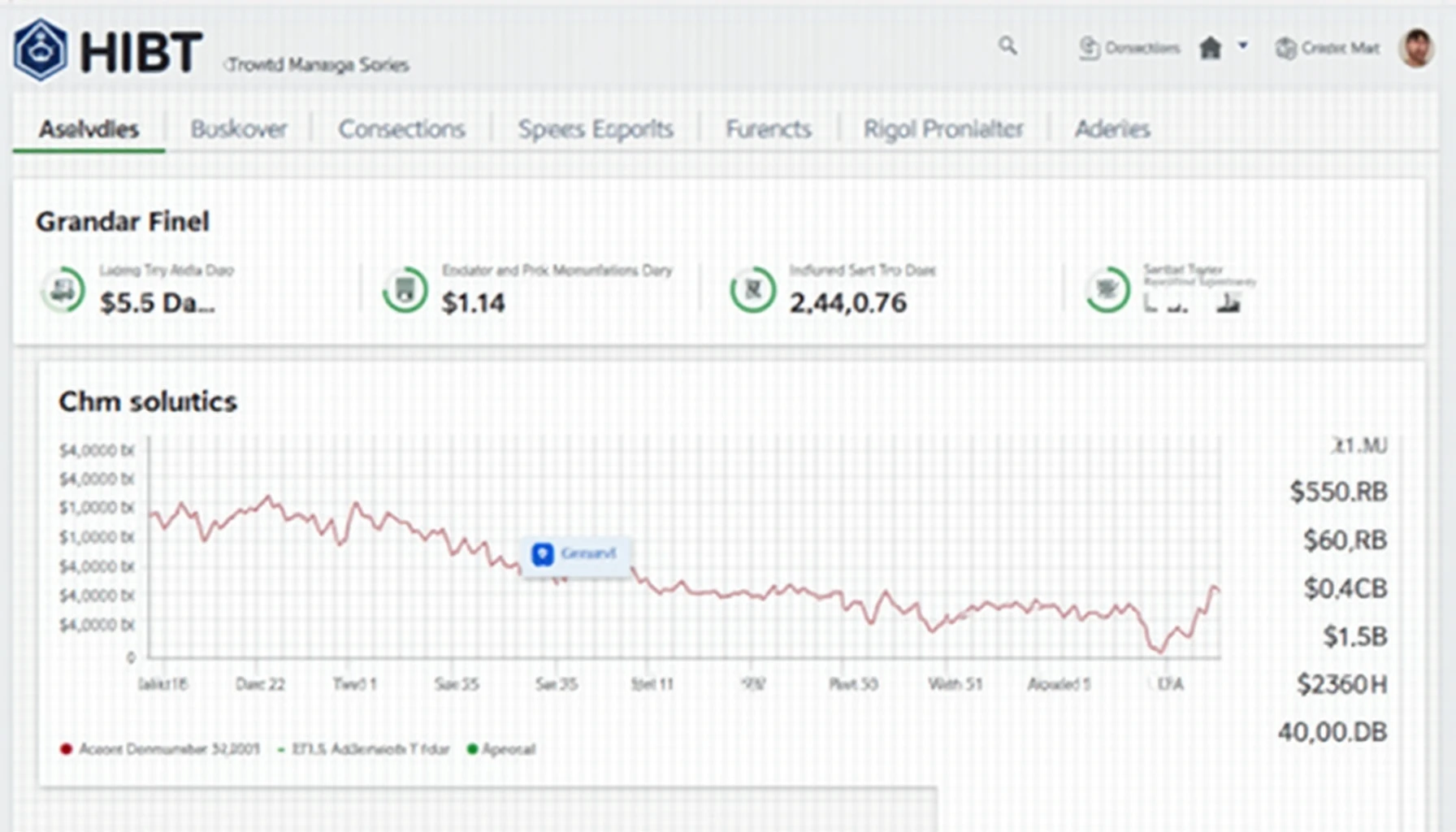

Understanding Hibt Crypto Tax Tools

Hibt crypto tax tools help individuals and businesses manage their crypto tax liabilities effectively. With intuitive interfaces and comprehensive reporting features, these tools allow users to accurately report their gains and losses.

Why You Need Hibt Crypto Tax Tools

- Precise Calculation: Ensure you have accurate tax records.

- Time-Saving: Automate your tax reporting process.

- Compliance with Regulations: Stay updated with local regulations.

Benefits of Using Hibt Tools

Here’s the catch: implementing effective tax tools can save you from hefty fines during audits. Like a well-secured vault for digital assets, Hibt tools create a safety net for your financial records.

Key Features of Hibt Crypto Tax Tools

- User-Friendly Interface: Intuitive design for everyone.

- Real-Time Data Integration: Syncs with your crypto exchanges.

- Customizable Reports: Tailor reports to your accounting needs.

Local Market Insights

In Vietnam, the cryptocurrency user growth rate has skyrocketed. With an estimated 6 million crypto users, local compliance has become more crucial than ever. Utilizing Hibt can empower Vietnamese investors to manage their tax obligations effectively, ensuring peace of mind.

Conclusion

In conclusion, Hibt crypto tax tools are indispensable for anyone involved in cryptocurrency investments. Their user-centric design and robust features provide significant advantages in tax compliance. For more detailed insights, visit our website.

Author: Dr. John Doe, a recognized blockchain tax specialist with over 15 published papers and experience leading major project audits.